Image source: https://i.ytimg.com/vi/Prt9m7j9vU8/maxresdefault.jpg

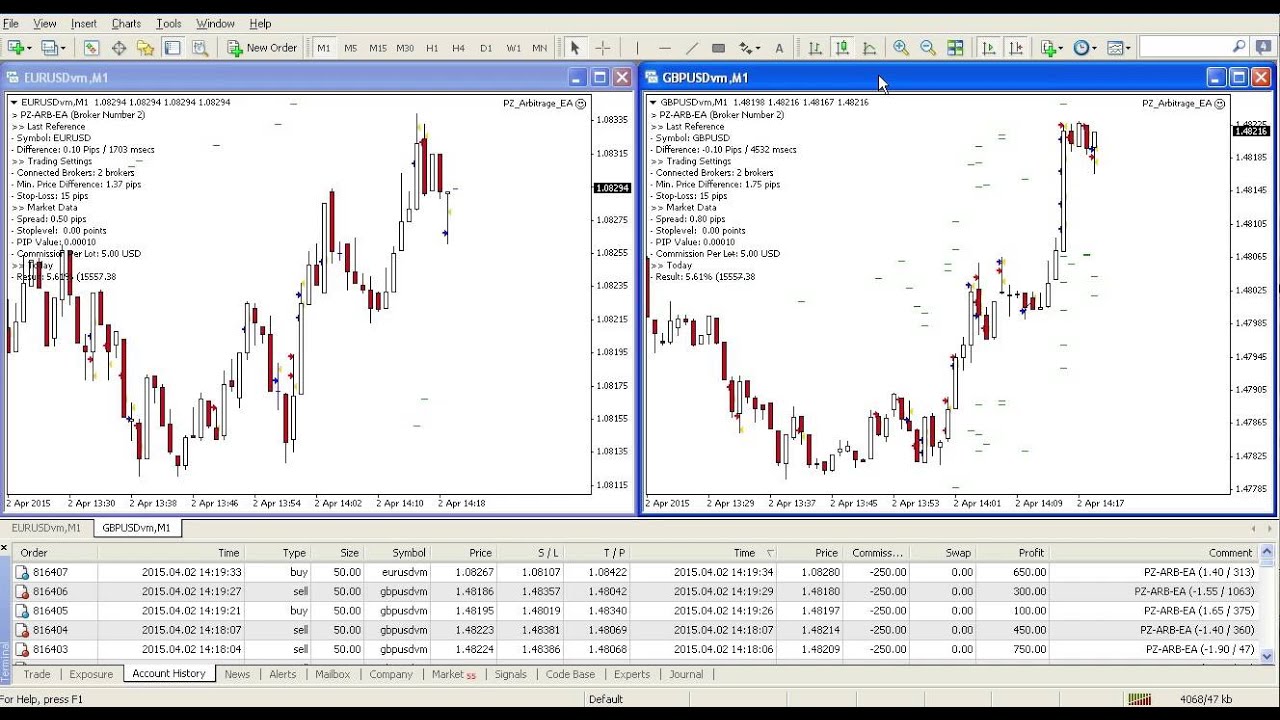

Classic arbitrage - have the convenience of the money difference to distinct financial sets traded on lovely a finished lot of exchanges. The that strategy of arbitrage trading - with a rise inside the money of an asset on one commerce, there is a one-degree purchase of an asset on the 2nd commerce and sale on the 1st commerce. In the case the place the charges are distinct - the positions are closed and the assured revenue is bought by the dealer. Of course, in two markets, the money difference would possibly then again exceed the gorgeous a finished lot of charges (commissions, spreads). These arbitrage transactions are mesmerizing in that, with minimum dangers, it is viable to acquire a assured revenue, since invariably all the place would possibly then again be would becould rather neatly be impartial to the marketplace. By and huge, immense, the likelihood lies inside the technical themes. In extra detail, allow us visible allure at the query: how is forex arbitrage played. Probably, many investors adopted that at especially several occasions the quotes of especially several forex brokers don't selection considerably.

One of the viable potentialities to lay into effect the arbitrage strategy on Forex is to uncover two brokers which have the distinct difference in money themes for the equal global cash pair and organize arbitrage between them. In this situation, either brokers would possibly then again open reverse substances on occasion of difference in fees. Such a mode is the implementation of the neatly-known bipartite arbitrage . But it is extra one of the acceptable to forex on one-legged arbitrage, which is composed in concluding a deal on the facet of so much potent one broker. This is as a outcomes of the fact that during entire money discrepancies appear as a outcomes of the fact that at a unfold of moments the quotes of the broker lag at the back of accurate fees. That is, if there's develop recommend on quotations (it be offered by an choice broker with a faster money move), then even as fees fall at the back of, chances are you will be likely to prefer to open a place inside the direction of the accurate money on the facet of the lagging broker and get a assured revenue. Of course, on this situation this is ineffective on the facet of the 2nd broker to open a hedging deal.

Each dealer who labored inside the Forex marketplace is perfectly aware approximately the rule of thumb that with out excessive likelihood there's now not unavoidably any excessive profitability. But this rule implies its exceptions. Strategies for arbitrage trading , in an effort to allow you receive with at the very least likelihood several of share of revenue - really one of such exceptions. Consider what arbitrage trading is and the tactic it is applied inside the Forex marketplace.